- Home

- Content Library

Content Library

How Two Best Friends and Dental Partners Designed Their Dream Office

How Two Best Friends and Dental Partners Designed Their Dream Office What’s the most unusual design feature of Mattson Hellickson Dental in Beaverton, Oregon? Here’s a hint: It isn’t the living room-like waiting area with the gas fireplace, the windowed sterilization room with an open, restaurant kitchen feel, the state-of-the art digital equipment or even the comfy A-Dec® chairs in the operatories. It’s actually the outdoor firepit, which adds a casual, relaxed vibe to this thriving practice run by former college friends and partners, Samuel Mattson, D.D.S., and Benjamin Hellickson, D.D.S. It’s the first outward sign of their patient-centered philosophy, their attention to detail and their welcoming spirit that informs every

How CEREC® Unlocked a Patient-Centered Workflow: One Doctor’s Journey

Establishing her dental office in what she describes as “a pretty remote location,” Robin Henderson, D.D.S., owns a general practice in Clarkston, Washington — a community that sits on the Washington-Idaho border, roughly two hours south of Spokane and five hours north of Boise. It’s a community that Dr. Henderson describes as not only an ideal place to build a dental practice, but also a city with a patient base that embraces the use of digital technology for their oral health care needs. One of the biggest “secret weapons” that Dr. Henderson has in her arsenal is computer-aided design (CAD)/computer-aided manufacturing (CAM) technology. In this article, we will detail

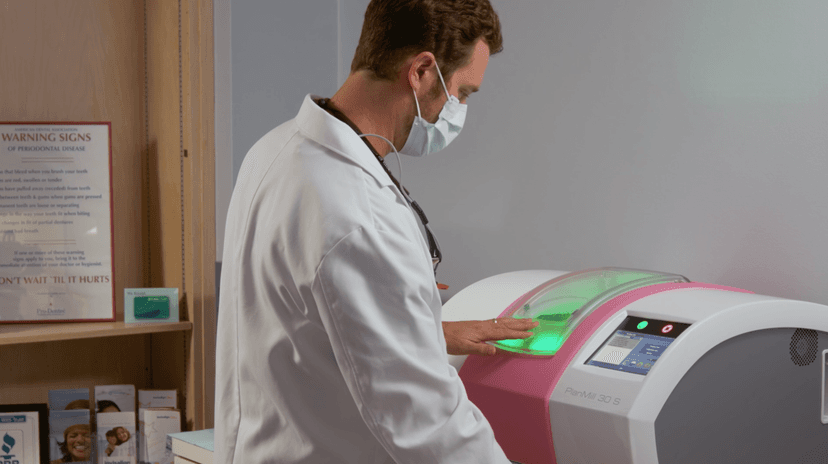

The Advantages and Possibilities of 3D Printing for Any Dental Practice

While 3D printing has been available for dental practices for several years, there have still been roadblocks for many dentists and team members when it comes to incorporating the technology into their treatment mix. One of the biggest barriers has been a lack of understanding of what benefits 3D printing can provide for patients, as well as how it fits into the overall digital technology flow of the practice. With those thoughts in mind, let’s take a look at the current state of 3D printing and what its introduction into a practice could look like. Steps to understanding 3D printing First and foremost, if you’re considering taking first steps

Dental Practice’s Growth, Inspired by Design

Dr. Jeffrey Alvarado teamed up with Henry Schein to reimagine dentistry with the construction of his new office space. The result: A jaw-droppingly elegant facility with all new state-of-the-art equipment and a workflow that enhanced office efficiency, as well as patient comfort and retention. When The Lakes Family Dental opened the doors to its new facility in May 2021, patients were immediately wowed by the transformation, leaving their anxieties outside the door. Dr. Alvarado, owner of The Lakes Family Dental in Edinburg, Texas, achieved in one year something that most dental practices take years to do: He nearly doubled his 22-year-old practice by both the number of patients seen

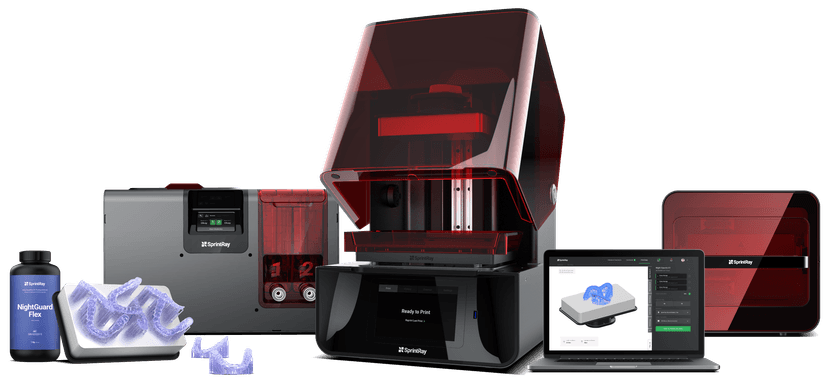

The Definitive Guide to 3D Printing Dentures

3D printing is becoming increasingly popular among dental practices looking for a better approach to producing dentures. The ability to create dentures in-house means patients receive their dentures faster, and they often get a better fit. It’s also much easier to replace the dentures and reprint them if the patient needs a replacement. The basics of 3D printing The 3D printing process starts with an intraoral scan. Using an intraoral scanner, the dental assistant can scan the patient and generate an STL file. From there, the dentist can design the restoration themselves or send it to a lab to create it. To get started with implementing a 3D printing workflow,

CBCT and its Benefit to Your Practice and Patients

Through the years, there have been countless advances in the field of dentistry. When it comes to technology and what is available to today’s dentist and dental team, those advances have taken mighty leaps. In this article, we will take a look at cone beam computed tomography (CBCT) and how its introduction into dentistry has given both general dentists, as well as specialists, a new option to better serve their patients and the ability to explain in greater detail any issues that might be occurring in the patient’s head and neck region. What is CBCT? By definition, CBCT is an advanced, highly accurate method of imaging that can provide a

How Digital Technology is Transforming the Manufacture of Occlusal Splints and Night Guards

Modern technology has changed the world of dentistry. In particular, digital impressions have made the manufacture of various items, like occlusal splints and night guards, much easier. Physical impressions take time and need to be entirely recreated when there are changes in a patient’s mouth. Not surprisingly, this is something most dentists don’t particularly enjoy spending time on. But, it’s not only dentists who tend to dislike physical impressions. Patients also find them to be time-consuming — not to mention, uncomfortable. Since physical impressions need to be pressed firmly into a patient’s mouth, they can cause loose teeth to move around, as well as night guards and occlusal splints that

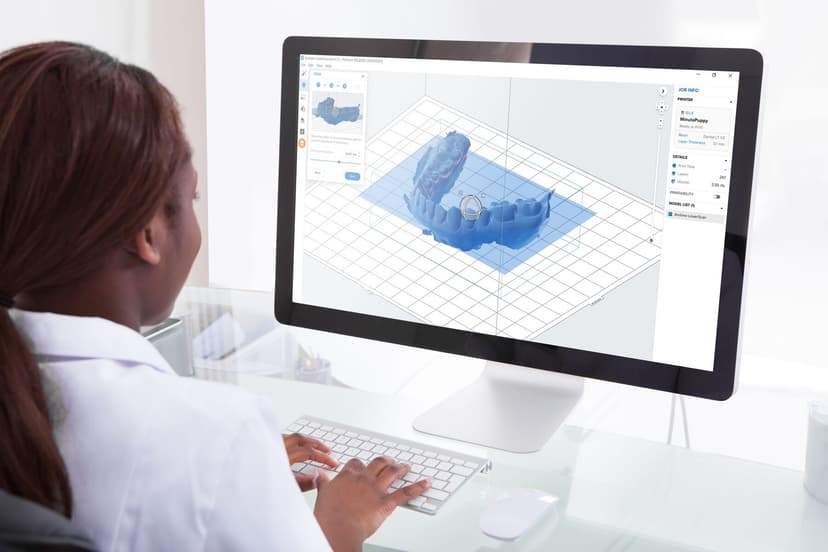

3 Beginner Applications for Dental 3D Printing

When it comes to 3D printing, many dentists have questions about where to start. Incorporating new technology can be somewhat daunting, but choosing the right applications — and applying the right workflows — can help set your practice up for success. Dr. Alan Jurim, director of digital dentistry with Touro College of Dental Medicine and founder of CADPRO Academy, recently shared some helpful guidance in his webinar, “The 3 Beginner Applications in Dental 3D Printing: Surgical Guides, Models and Splints.” Here’s what you need to know. Elements of 3D printing 3D printing essentially involves three steps: Inputting information, processing information and outputting that information. * Inputting information: Intraoral scanners,

Go-to Strategies for Integrating 3D Printing into Your Dental Practice

Many general dental practices are taking advantage of 3D printing to create all kinds of devices that make life easier for patients and streamline dental procedures for practitioners. The technology has evolved quickly in recent years, enabling dentists to print models to make aligners, as well as models for orthodontic work, crowns, dies for lab cases, dentures, surgical guides, ortho bracket trays, night guards and wax-ups. 3D printing is an additive manufacturing process that creates a physical object from a digital design. The process involves laying down thin layers of materials, such as powder plastic, metal or cement, and then fusing the layers together. This approach offers a wealth of

Perfect Implants Take Planning

When managing a thriving dental implant practice, it’s important to keep in mind that it is more a science than an art. The process has to be even more precise than the end result is esthetically pleasing, in order to maintain the integrity of the work and the health of the patient’s mouth for years to come. Guided implant surgery with strict digital workflows is the key to optimal outcomes. These require digital implant planning strategies, which are now readily available, thanks to the most up-to-date 3D imaging technology. Just a few years ago, 3D imaging seemed too advanced to ever become standard equipment; it was also way

Getting Started with CAD/CAM Dentistry

Dentists who have yet to make the leap to computer-aided design/computer-aided manufacturing (CAD/CAM) dentistry often have questions about how to be most productive with this new technology. With the right workflows and scheduling, you can be highly productive, increase profitability and keep your patients happier. One major benefit of CAD/CAM is the ability to offer same-day restorations by scanning, designing and milling in-house. Patients appreciate this, because they don’t have to deal with temporaries or come back multiple times. And it makes for a happier dentist, too, because you can make the best use of your time. Gaining workflow efficiencies A CAD/CAM workflow offers many time efficiencies. The biggest time

Best Strategies for Launching a Successful In-Office Dental Laboratory

The dance between the dental practice and the dental laboratory has been choreographed for decades. However, technology is changing what that dance may look like — today and in the future. While many practices have found a lab that meets their needs and quality requirements, there are also many practices that are considering what it would take for them to produce their own cases in-house rather than sending them outside the practice. In this article, we will look at some of the questions that should be answered and strategies that should be incorporated if you are planning to launch your own in-office dental lab. Know your why Before deciding if an

Is 2022 the Year to Sell Your Dental Practice?

The rebound of dental practices from the pandemic have been extremely strong, with the most recent American Dental Association (ADA) data showing that patient volume is at 90% of pre-pandemic levels. For most practitioners, economic confidence is very high. Many practice owners who put sale plans on hold during the COVID-19 pandemic are revisiting their plans. “It’s a seller’s market, with many practice values rebounding from 2020 or exceeding their pre-pandemic levels,” says Dr. Thomas Snyder, senior director of transition services with Henry Schein Dental Practice Transitions. “Bank lending is also very strong, and interest rates remain low.” Practice valuations vary based on dental location, earnings/cash flow and other factors,

Diagnostics in Action: Addressing Temporomandibular Disorders and Sleep-Disordered Breathing

The evolution of imaging technology has enabled dentists to expand the diagnostic services they can offer to patients. Many practices are taking advantage of these capabilities to help patients suffering from airway and joint conditions such as sleep-disordered breathing (SDB) and temporomandibular joint disorder (TMD). Understanding SDB This condition occurs when there is obstruction of the airway, decreasing the airflow by upwards of 25% for longer than 10 seconds at a time. The past two decades have seen a growing number of people with these conditions. Roughly 23 million adults in the U.S. have undiagnosed or untreated moderate-to-severe obstructive sleep apnea, according to a study in the Journal of Dental

How Cone Beam Computed Tomography Can Supercharge Your Endodontics Practice

Many endodontists are curious about cone beam computed tomography (CBCT) and what it would be like to use this advanced imaging technology in their practices. Often, their questions are practical ones: What is the importance of CBCT? When should it be used: preoperatively, intraoperatively and postoperatively? Are all CBCT units the same? How do you read a CBCT scan? How do you interpret the results? To shed some light on what it’s like to use CBCT in daily practice, Dr. Stephanie Tran, an endodontist with a private practice in New York City and Long Island, New York, offered insights based on her own use of CBCT. Dr. Tran finished

Ready for a Refresh? What to Consider When Remodeling, Expanding or Moving Your Practice

Nothing stays the same, and dental offices are no exception. From updating the décor to expanding treatment spaces and improving workflow and ergonomics, there are a number of reasons why a practice might consider a remodel or renovation. Establishing goals Exactly how you go about making those changes depends on what you aim to accomplish, of course. Take, for instance, the question of patient perception. It's an important part of a practice's success, but one that can be easy for providers to overlook. For a dentist or hygienist who is in the office every day, a stained ceiling tile or chipped piece of laminate can easily fade into the

Non-Profit Surgical Center Provides Care to Community

It’s often said that in life, seemingly small decisions can have lasting, transformative impacts. And, for Dr. Justin Moody, a renowned implantologist, speaker and instructor, this concept rings true — on both a personal and professional level. Growing up in rural Nebraska, he had always envisioned following in his father’s footsteps and taking over his family’s fifth generation ranch. Little did he know, a mentor would one day enter his life and guide him in an entirely different direction, encouraging him to apply to dental school, thereby changing the trajectory of his career from that point forward. "He steered me on the path to implant dentistry,” says Dr. Moody.

Which Intraoral Scanner is Best for Your Practice? Here’s a Look at the Latest Technology

Whether you’re preparing to use clear aligners, or performing restorative work, such as crowns and bridges, the right intraoral scanner can be a game changer when it comes to capturing a full arch impression. But scanning for clear aligners and dental restorations can be a challenge, and requires the right equipment and skill to capture interproximal data, applicable hard and soft tissue, as well as the distal of the most posterior tooth. To help identify the right scanner to use, Matt Kunzler, a technology advisor with Henry Schein, has taken the time to compare and contrast four of the market’s leading products that have been optimized for full

In-office 3D Printing: Financial and Business Considerations

When it comes to 3D printing, the question isn’t solely about whether it’s good for your dental practice — it’s also about what steps are needed to successfully leverage the technology. This means understanding the printer and its capabilities, as well as your mindset around printing, and whether it makes financial sense for your business. Many practices take full advantage of 3D printers to produce a range of items, including night guards, dentures and surgical guides, as well as permanent restorations. Doing so not only improves efficiency for the practice, but also increases patient satisfaction through faster treatment. Low entry price point for 3D printing and increased self-sufficiency Now may

Unlocking the Mysteries of Cracked Teeth and Vertical Root Fractures

Cracked teeth and vertical root fractures can be challenging to diagnose and manage, regardless of whether a root canal is needed as part of the patient’s treatment plan. In addition, dental offices are seeing more and more cases within the past year. In fact, both problems seem to be on the uptick as a result of stress-related tooth grinding during the pandemic, as well as an increased use of non-ergonomic desks and tables that can cause jaw and tooth pain — necessitating the importance of proper assessment and care. In this article, we’ll take a closer look at how to tackle the intricacies of diagnosis and treatment of

Don't Let Chronic Pain Cut Your Career Short: Steps to Proper Ergonomic Positioning

As practitioners know all too well, dentistry involves the kind of awkward static poses and repetitive movements that can lead to injury and pain. Cumulative trauma disorder — when your body accumulates small injuries more quickly than it can repair them — can lead to a variety of issues, from difficulty gripping instruments to pain or numbness in affected areas. Good ergonomic positioning is key to avoiding these kinds of injuries, but maintaining proper posture can be a challenge — especially given the range of movements and stances required by a typical day of dentistry. That makes the use of ergonomic equipment and careful attention to both clinician

Strategies for Practicing Ergonomic Dentistry: The Key to Extending the Length of Your Career

The average dentist will spend up to 60,000 hours during their career working in tense and distorted positions, according to a 2014 International Journal of Clinical Pediatric Dentistry article. Prolonged work in less-than-ideal positions can cause chronic injuries. Given the physical nature of dentistry, proper ergonomics are necessary to help prevent injuries that could throw a wrench into a thriving practice. With the right ergonomics in place, dentists can help reduce the likelihood for common musculoskeletal disorders (MSDs), enabling them to better protect their bodies and enjoy their profession for as long as they like. Prevalence of MSDs The potential that improper positioning can have on a dentist’s physical well-being is

Why 3D Imaging is Changing the Game for Implant Treatment Planning

Practices increasingly rely on cone beam computed tomography for implant imaging and treatment planning. Pre-implant imaging helps to improve diagnoses. It allows for optimal implant selection, prevents surgical surprises and can serve as a basis for guided surgery. It is also incredibly important for legal documentation. Increased importance of documentation “We live in an increasingly litigious society, and as practitioners, it’s wise to take steps to demonstrate that you did the proper planning for patients,” said Dr. Heidi Kohltfarber, oral and maxillofacial radiologist and founder of Dental Radiology Diagnostics. “If anything were to go wrong with the implant placement, having CBCT imaging to show that you planned accordingly based on

Pediatric Dentists Embrace Coastal Theme in Pensacola, Florida

Idyllic white sand beaches. Turquoise water. Palm trees gently swaying in the breeze. These quintessential sights and surroundings of Pensacola, Florida, are a calming presence for both locals and visitors alike. It’s the type of tranquility that Drs. Allison and Neil Simmons hope patients will instantly feel when they walk through the doors of Pensacola Kids Dentistry — whether for a routine cleaning or for their very first dental visit. As board certified pediatric dentists, this husband-and-wife duo opened Pensacola Kids Dentistry in 2014, right out of residency, with the hopes of teaching children and adolescents the importance of establishing healthy oral health habits to last a lifetime. “I truly