For most dentists, the main objective of attaining a dental degree is so they can apply their trade and help patients enjoy the benefits of good dental health.

We tend to enjoy doing the work, interacting with a wide variety of people, setting our own schedules, being our own boss, and from time to time, creating much out of not-so-much. It is always a good feeling to sit down with a patient who has a dental problem, help solve that problem because of our skill sets and knowledge base and, have the patient thank us for helping them.

When we applied to dental school, we knew it was not going to be cheap to attend (and it would not be easy to get by on four years of income in some other field), but we felt that it would eventually be a good investment.

When we become the owner (chief financial officer) of our dental practice, oftentimes we are asked to make decisions about spending money, so knowing how to evaluate the difference between cost and investment is critical. Dental practice owners really need to have an effective method of keeping track of what is going on in their practices and having the tools they need at their fingertips so they can take advantage of opportunities as they present themselves. As the old saying goes, “It is better to be prepared and not have an opportunity, than to have an opportunity and not be prepared.”

For more than 20 years, I have worked with dentists around the country. I’ve provided strategies and coaching to help them achieve their practice goals, preparing them to be ready for opportunities. Then I’ve helped them evaluate those opportunities to make intelligent and informed decisions. Unfortunately, most dentists don’t have simple, easy-to-implement systems that can expedite the business management processes, so they are at risk when they need to make well-informed decisions and run highly effective practices.

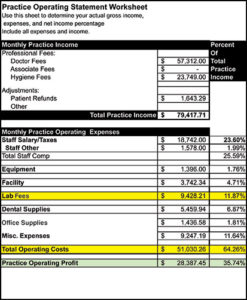

Figure1 (Monthly Practice Operating Overhead Statement Before CAD/CAM)

In this article, we are going to focus on one aspect of business management—operating overhead, how best to categorize it, and how to get real “apples to apples” comparisons. We are going to look at what happens when a dentist goes from sending out all lab work to the real effects of having an in-office CAD/CAM machine and how to structure a Monthly Practice Operating Overhead Statement Worksheet so you know what’s going on in your practice at a moment’s notice. If I spoke with you today to discuss your practice operations and you could not give me up-to-the-minute information as shown below, you’ve got work to do. If you don’t believe me, think about how long it takes well-run corporate practices to “take their pulse.” I can tell you that corporations running multiple practices are getting real-time production, collection, accounts receivable, and overhead numbers, so they know at any given point in time where they are.

We’re moving into an era where we have an increasing number of dentists that have CAD/CAM computerized milling machines, and those users are not utilizing traditional dental labs as before. If you have one of those machines, my preference is that anything you pay out, including the monthly charge for the machine and the cost of supplies, goes under a subcategory in lab fees. If you were providing laboratory restorations and you weren’t using that machine, you would be paying a lab fee.

The laboratory expense is but one of eight major categories that all dentists should have laid out in their operating statements. Below is an overview of “what to look for in your operating overhead statement” as well as the other seven categories.

What to Look for in Your Operating Overhead Statement

Reviewing an Operating Overhead Statement is important in evaluating what is occurring financially in a practice and to see if there are areas that need to be redirected. If you really want to know where the operating expenses fall, you need to properly categorize them to determine the direction of the practice. You need to be able to see this at a moment’s notice, not in a report 30 days or more after the end of the quarter. No real business would operate without up-to-the-minute facts, so why would you?

- Staff Salaries/Taxes–This includes the staff compensation plus any taxes you pay on behalf of the staff (20–23% for general practices, including hygiene).

- Staff (Other)–Generally includes staff benefits such as insurance, pension contribution, CE costs, and gifts (0–3%).

- Equipment–This includes equipment leases or purchases, repair and maintenance for equipment, and annual taxes assessed and paid on the equipment you have (3–5%).

- Facility–This includes rent or mortgage payment, utilities, facility maintenance, and property taxes (3– 5%).

- Lab Fees–This includes all outside lab costs and any CAD/CAM materials/ supplies and the cost of the CAD/CAM machine (9–15%).

- Dental Supplies–This would include normal disposable dental supplies used daily, restorative supplies, impression materials, and patient products (6–7% for total supplies).

- Office Supplies–This includes administrative items and supplies, postage and printing, computer services, and any other administrative costs (1–2%).

- Miscellaneous Expenses–This includes marketing costs, bank charges, books/ subscriptions, consulting fees, dues and licenses, interest expenses, legal/accounting expenses, travel/entertainment, telephone costs, and other expenses (7–10%).

You will have some one-time expenses, such as paying a year’s insurance in advance, that will throw your percentages off, but these will balance out over time. The important thing is to see what is out of line and why it is. If you are not sure, that item or items will bear further investigation. Note that this will only be a few items each year, so the time spent investigating these will be minimal.

In the past, most have filed CAD/CAM monthly payments under equipment and CAD/CAM supplies under dental supplies, when in actuality, they are neither. That particular piece of equipment has a specific use and it’s really a laboratory use function.

For tracking actual operating expenses, we have long recommended that practices include payments for the CAD/CAM equipment and all CAD/CAM supplies, and categorize them under laboratory expenses. Because you want to compare “apples to apples,” you must keep all laboratory expenses together. For the purpose of really knowing your costs and determining profitability and pricing on your comprehensive P&L statement, you will probably want to subdivide the laboratory expense category into:

- Fixed pros

- Removable pros

- Implant pros

- CAD/CAM pros

- Appliances

- Ortho

You could further break down CAD/CAM pros into:

- Lease payment

- Supplies

- Repairs and maintenance

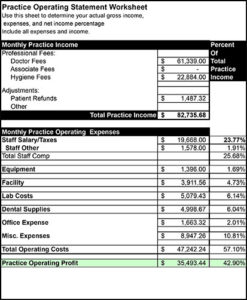

Figure 2 (Monthly Practice Operating Overhead Statement After CAD/CAM)

This will allow you to immediately see each part of the equation and how you are doing. Your accountant can handle the expenses from a tax standpoint in a manner the two of you decide, but if you plan to be a successful dental practice owner, you need up-to-the-minute data on a real cash-in/cash-out basis. Having an operating budget and accurately tracking operating expenses will provide you what you need when you need it.

I once worked with a client who asked me to create a long-term plan on positioning their practice to lessen the effects of dental insurance, to make sure they had the proper staff on board, to raise the level of customer service and services in the practice, and to be well-positioned for the changes happening in dentistry. One of their practice operating expenses was laboratory, which, at the time, was running about $9,400 a month for outside lab services, mostly fixed prosthetics and crown & bridge. (see Figure 1) They were discussing the “cost” of the new CAD/CAM, which was over $100,000 at the time. The large number had them concerned.

We discussed “cost” versus “investment return,” and once the comparison was calculated, the decision was made to move ahead. The month following the introduction of their CAD/CAM machine was an eye-opener. Outside lab expenses dropped to just under $1,500: a $7,900 drop. CAD/CAM-related costs were about $3,600: a net gain of $4,300. (see Figure 2) They were elated, but soon found that was only part of the story. The marketing value from having the equipment was useful in attracting additional patients. They did more onlays and an occasional inlay, and they did more quadrant treatment on patients due to convenience for the patient.

Fast forward to 12 months: the practice realized a net gain compared to the previous 12 months with outside lab services of just over $63,000. I’m not sure where else in your practice you can do the same procedure and increase the revenue to that extent.

The most significant positive impact CAD/CAM has had on a practice has been financially. In most practices, a CAD/CAM machine can replace 75% or more of the lab costs. This should result in a significant increase in net profit without affecting production. It’s a real “no-brainer” if you provide restorative and crown & bridge services in your practice. In addition to dropping your lab costs, the patient will perceive your office to be high-tech and up-to-date on the latest procedures. This leads to more referrals, and with the ability to do restorations at one visit, more quadrant dentistry.

This article was originally published in Sidekick Magazine.

Dr. Robert Willis and DentalCoach.com have worked with CAD/CAM users for more than 20 years and have extensive experience in strategic planning for dentists, streamlining practice operations, private coaching for dentists, in-office consulting and training, practice growth strategies and transitions, and comprehensive practice assessments.